The mortgage industry is undergoing a major transformation, largely driven by powerful demographic shifts that are redefining who buys homes and how they finance them. From Baby Boomers entering retirement to Millennials emerging as the dominant group of homebuyers — and Gen Z not far behind — lenders are being challenged to rethink long-standing practices and create flexible, inclusive solutions that better reflect the evolving needs of today’s diverse population.

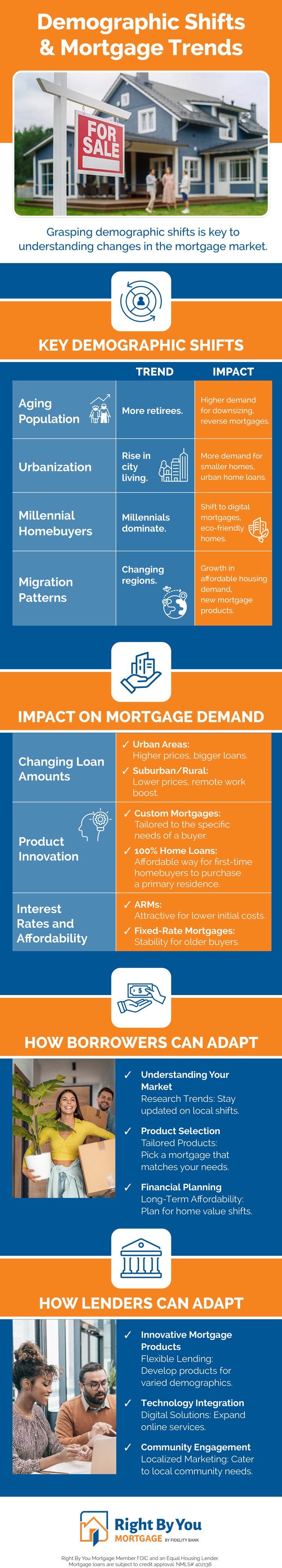

One of the most significant demographic changes is the aging population in many developed countries. Baby Boomers, who once fueled the suburban housing boom, are now approaching or well into retirement. Many are choosing to downsize into more manageable properties or to access their home equity to support their retirement income. Reverse mortgages have become increasingly popular as a financial tool that allows older homeowners to convert equity into tax-free cash while continuing to live in their homes. In response, mortgage lenders are not only expanding reverse mortgage options but also tailoring products for older adults looking to relocate or simplify their living arrangements.

Another driving force is the continuing trend of urbanization. Young professionals and even some retirees are gravitating toward city centers that offer better employment prospects, public transportation, and walkable neighborhoods. However, urban housing markets are often characterized by high property costs and limited space. To meet this demand, lenders are introducing mortgage products specifically designed for urban buyers. These include loans for micro-units, townhomes, and condominiums, along with adjustable-rate mortgages and creative financing for multi-unit dwellings. Additionally, the rise of co-living arrangements has encouraged the development of innovative lending models that accommodate shared ownership or rental income from tenants, further enhancing affordability in high-cost cities.

Millennials, now the largest cohort of homebuyers, are changing the game altogether. This generation prioritizes flexibility, convenience, and digital access. They are often burdened with student loans and rising living costs, making it difficult to save for large down payments. To address this, lenders are increasingly offering low- or no-down-payment mortgages, first-time buyer assistance programs, and down payment grants. But financial accessibility is only part of the equation. Millennial buyers expect a seamless, tech-enabled experience. In response, mortgage providers are investing in digital platforms that allow for online applications, electronic document submissions, and virtual consultations. This tech-forward approach is also attracting members of Gen Z, who are beginning to explore homeownership earlier than expected.

Beyond generational and geographic trends, cultural diversity is also reshaping mortgage strategies. Immigrant communities and multicultural families often have unique financial circumstances and cultural preferences when it comes to home buying. Lenders that provide multilingual support, culturally competent loan officers, and tailored outreach programs are more likely to build trust and long-term relationships within these communities.

These demographic dynamics are not just influencing what types of homes people buy or where they buy them — they’re also reshaping how mortgage providers position themselves in the market. For instance, localized solutions are becoming increasingly important. Communities like Winston-Salem, North Carolina, with a growing population that includes both retirees and young professionals, are prime examples of where customized mortgage strategies are essential. Mortgage services in Winston-Salem are adapting to serve a diverse clientele with varying income levels, housing preferences, and long-term goals. From historic downtown properties to new suburban developments, lenders in the area are designing packages that reflect the unique character and demographic makeup of the region.

In the face of these changes, mortgage lenders must remain agile, tech-savvy, and attuned to the needs of a shifting population. Those that can innovate while maintaining a strong connection to their local markets will be best positioned to thrive in the years ahead. As the housing landscape continues to evolve, staying ahead of demographic trends will be critical to delivering value to both current and future homeowners.